Your Path to Financial Flexibility or Freedom: The Power of Compound Interest

According to legend, Albert Einstein was asked: "What is the most powerful force in the universe?"

His response: "Compound Interest."

The sooner you start investing, the better you can benefit from the miracle of compound interest.

What Is Compound Interest?

The longer the duration, the larger the increases in your money become as your interest and gains from later years builds upon your savings and investments and already added interest and gains from earlier years.

In fact, it has an almost exponential effect:

The Outrageously EASY Way To Get Rich | Compound Interest

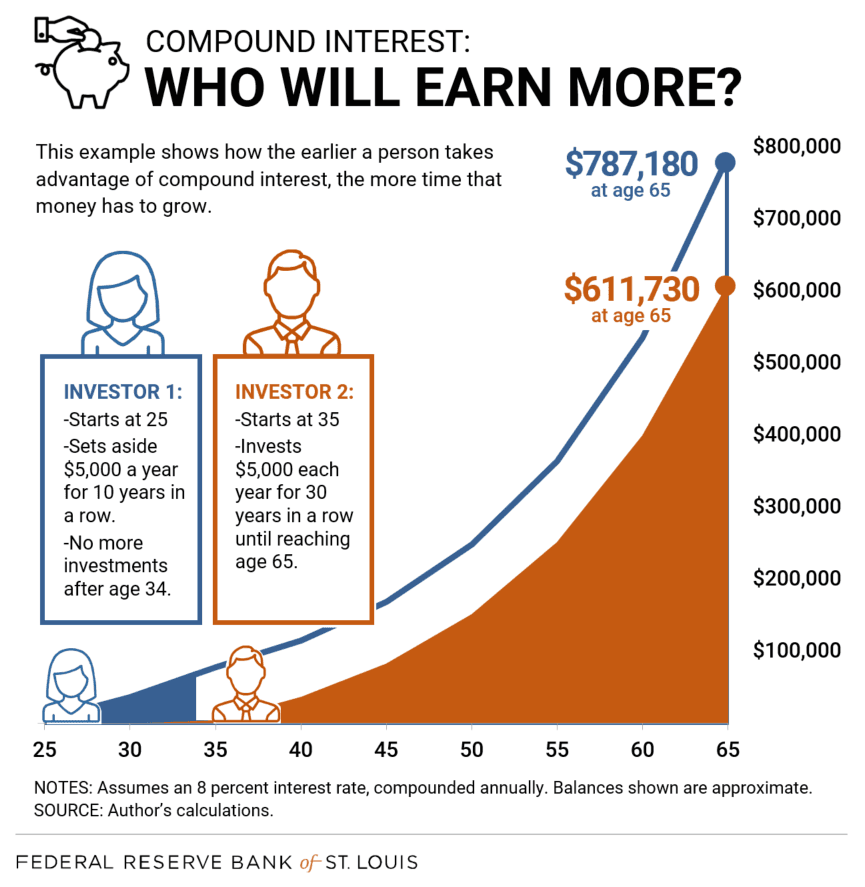

The graph below shows how important it is to start saving and investing money as early as possible, to take advantage of the power of compound interest. As you can see, starting young gives a person a major advantage in increasing his or her net worth, and offers flexibility in saving and budgeting during later years.

The Importance of Starting Investing Early

For a lot of young people, saving and investing may be the last thing on their mind. They want to enjoy their money, and may live paycheck to paycheck. Showing them this graph and more information about compound interest may help to convince them otherwise.

If you are a parent, you may wish to share this with them during their teenage or early twenties years, to help them get on track to having a comfortable retirement, or even enjoying financial freedom beforehand.

Optimal Ways To Invest

As far as how to invest, you may want to have your investments be part of an overall financial plan, as outlined in the financial life area of this website. In general, here is an excellent article regarding “conservative”to “aggressive” portfolios, based on your time frame and risk tolerance.

There are also "target-date funds" that balance out your portfolio as it goes along, according to your requested timeline and risk tolerance.

An investing method that is recommended for most people, by famous value investor, Warren Buffett, is to put your money into a fund that matches the S&P 500.

As far as how often, and how much to invest, the general recommendation is to do it periodically, by dollar-cost averaging, with the same amount of money at each time period - such as weekly, biweekly, or monthly.

If you are interested in investing in individual stocks, you may want to read my blog post on value investing, which is based on finding high-quality companies, whose stocks are at reasonable prices.

Begin Investing as Soon as Possible

So, if you and/or your youth are interested in taking advantage of the incredible power of compound interest, and meeting your financial goals, you may want to get started saving and investing today! Even if you are past your twenties, compound interest can still work for you, and it is never too late to start!

Disclaimer: This article is meant for informational and example purposes only. I am not a financial advisor, and am not promoting the purchase or sale of any kind of securities or funds. Also, I recommend that investing should be done within the framework of a comprehensive financial plan, with risks taken into account. You may also want to consult with a Certified Financial Planner.